What is Escrow? How Does it Work and What are its Advantages?

What is escrow?

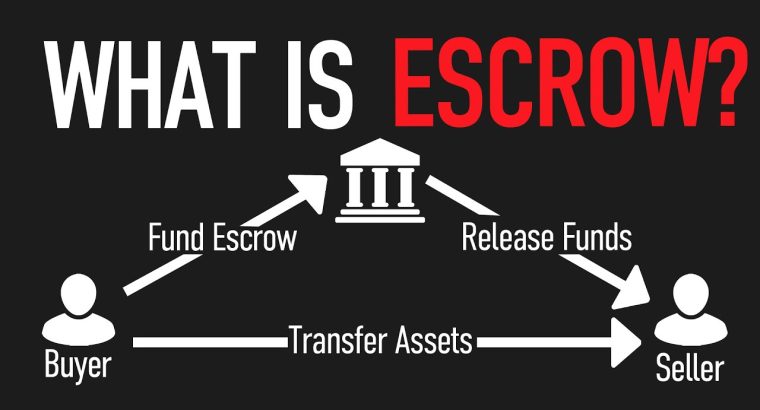

In simple terms, escrow is a third-party service that holds money during a transaction.

Escrow is often used in real estate transactions, but it can also be used for other types of transactions, such as online purchases.

Why is escrow important?

Escrow protects both buyers and sellers in a transaction.

For buyers, escrow ensures that they don’t pay for a product or service that they never receive.

For sellers, escrow protects them from fraud and allows them to get paid for their work.

How does escrow work?

In most cases, the seller sets up an escrow account with a third-party provider

An escrow is a service that holds money or property in trust during a transaction. Escrow is commonly used in real estate transactions, but it can also be used for online purchases.

In an escrow transaction, the seller does not release the goods until the buyer has paid the full purchase price.

The escrow service is provided by a third-party company that acts as a neutral party in the transaction.

This company will hold the buyer’s payment until the seller has delivered the goods. Once the buyer has received the goods, the escrow company will release the payment to the seller.

If you are planning to buy or sell goods online, you should use an escrow service to protect yourself from fraud. In this article, we explain how to use escrow and how it can benefit both buyers and sellers in an online transaction.

An escrow account is a holding account set up by a neutral third party to hold deposits or other funds during a transaction. This type of account is often used in real estate transactions to ensure that the buyer’s funds are available to the seller when the transaction is completed. Escrow accounts can also be used in other types of transactions, such as business mergers or the sale of a business.

There are many benefits to using an escrow account in a transaction. First, it ensures that the funds are available when they are needed. This can be important in a real estate transaction, for example, where the buyer needs to have the funds available to pay the seller at the close of the transaction. Second, using an escrow account can help to protect the parties involved in the transaction. For example, if the buyer needs to back out

Escrow is a great way to secure transactions online. It protects both buyers and sellers by ensuring that the terms of the deal are met. Escrow also offers dispute resolution in case there is a problem with the transaction. For these reasons, we recommend using escrow on Debtcatcher to secure your transactions.

Debtcatcher has partnershiped with Transpact.com to provide Buyers and Sellers the best and safest solution to securize their transactions.

Going through an escrow is not free of charge but Transpact.com is one of the cheapests on the market. It also obliges to go through a more complicated process but this is the only way to make things fully safe for both parties.

Of course, choosing the escrow option is not mandatory but is the safest way not to get scammed.