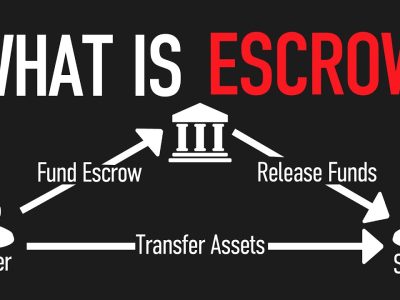

What is Escrow? How Does it Work and What are its Advantages?

What is escrow? In simple terms, escrow is a third-party service that holds money during a transaction. Escrow is often used in real estate transactions, but it can also be used for other types of transactions, such as online purchases. Why is escrow important? Escrow protects both buyers and sellers in a transaction. For buyers, […] Read More

Why debt buying is a smart financial move

Debt buyers are companies that purchase debt from lenders at a discount and then attempt to collect it from the borrower. The debt buying industry has grown in recent years as lenders have become more willing to sell debt, and investors have become more interested in buying it. There are several reasons why debt buyers […] Read More

The Main Causes of Debt in 2022

The debt collection market in the US continues to show resilience. The industry is currently estimated to be worth $14.99 billion, with Market Research forecasting an average growth of 2.8% per year that will place its valuation at $16.7 billion by 2025. It has led to an invigorated debt buying sector, with average collection firms […] Read More

How to avoid scams buying on debtcatcher

First thing first, if you want to check about debtcatcher’s own trust rating, have a look at scamadviser’s review. Our platform is rated 100% Here are some tips to help you spot and avoid scammers Scammers will often deceive victims into thinking they’re good, honest people. They will tell you a believable story about being […] Read More

Debtcatcher.com shortlisted as a finalist at the 2022 Credit & Collections Technology Awards – Manchester UK

Manchester November 17th 2022Let’s go get it ! Read More

The unsexy side of the debt purchasing industry

The unsexy side of the debt purchasing industry is often criticized for its practice of “debt selling.” This is the process of selling debt to third-party debt collectors for a fraction of the face value of the debt. The debt collector then attempts to collect the debt, often using aggressive and illegal tactics. Critics argue […] Read More

Should You Purchase Zombie Debt For Credit Repair?

1. So, you want to purchase some zombie debt? Zombies aren’t just for horror movies anymore! In fact, they’re now a part of the financial industry. No, we’re not talking about the undead walking around looking for brains to eat. We’re talking about zombie debt. 2. Now, what exactly is zombie debt? Zombie debt is […] Read More

An Introductory Guide on How You Can Buy and Sell Debt

The market for debt is rising this year, now that more Americans are trying to keep up with rising inflation rates. CNBC points out that the average U.S. household with debt owes around $155,622, which is up by 6.2% from last year. Out of all the different types of loans, mortgages, auto loans, and student loans made […] Read More

How to buy debt

If you have read my post “where to buy debts”, you now need to know how to buy debt. Assuming that you are in contact with a seller, you must ask the right questions and have access to some documents. In other words you have to conduct your due diligence. Due Diligence: “the detailed examination […] Read More