4 Ways Fintech Transforms Debt Purchasing and Credit Repair

Technology's moving at breakneck speed these days. And fintech has basically flipped the entire financial world on its head. If you've been wrestling with debt or trying to patch up your credit, you've probably noticed things work way differently than they did just a few years back.

Here's what's happening — banks are still scratching their heads over all those bad loans cluttering up their books, while regular folks are busting their butts trying to boost credit scores. Meanwhile, fintech companies have jumped in with some surprisingly smart solutions. Let me walk you through four ways they're completely changing how this stuff works.

Automated Data Analytics: Goodbye to Debt Buying Guesswork

You know how buying debt used to be, basically throwing darts at a board? Yeah, those days are dead and buried.

Fintech companies now have algorithms that tear through massive data dumps in minutes. Payment histories, spending patterns, economic shifts — they analyze everything. Instead of some poor analyst burning through weeks trying to figure out if a debt portfolio's actually worth anything, these systems pump out valuations that'll make your head spin with how accurate they are.

What does this mean for you? If you're stuck negotiating with debt collectors, they actually know what your debt's worth now. That's a double-edged sword — but hey, at least the process isn't just someone making up numbers anymore.

Digital Platforms Make NPL Management Way Less Brutal

Non-performing loans used to give bankers nightmares. Still do, honestly, but now they've got better weapons to fight back.

Companies like Tink built platforms that give lenders a crystal-clear view of borrowers' finances in real-time. It's basically X-ray vision for financial health. Banks can spot trouble brewing before it explodes and actually jump in to help.

The really cool part? These platforms pack in resources to help borrowers dodge default in the first place. Education stuff, budgeting tools, advice that's actually tailored to your situation. It's not just about squeezing money out of people anymore — it's about keeping them from drowning.

AI-Powered Credit Repair: Finally Something That Works Without Taking Forever

Credit repair used to be torture. Pure torture. You'd dispute something and then sit around for months, wondering if anyone even got your letter.

AI completely blew that up. Tools from companies like Credit Karma spot errors on your credit report instantly and kick off disputes right away. No more twiddling your thumbs, wondering if that bogus late payment from 2019 is actually yours.

The killer feature? These systems keep getting smarter. They'll catch new problems the second they show up and ping you immediately. It's like having a personal credit bodyguard that never takes a coffee break.

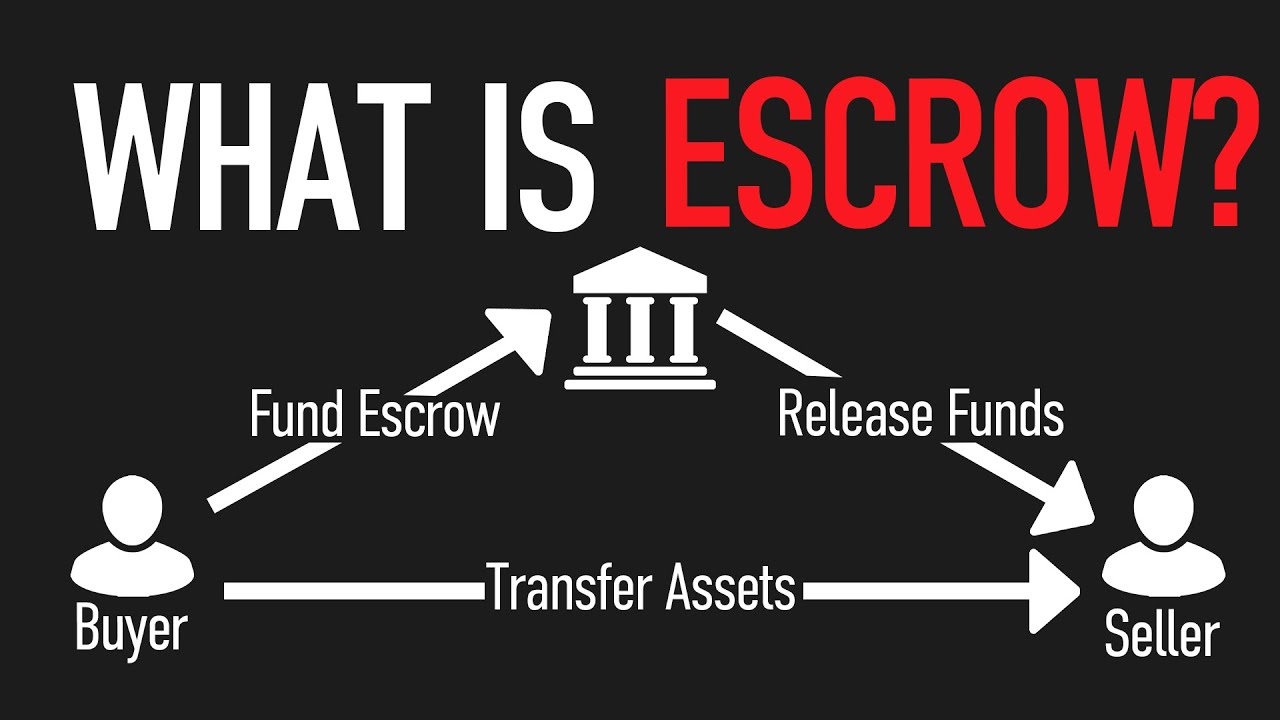

Blockchain: Making Financial Transactions Actually Bulletproof

Now this is where things get wild.Blockchain isn't just crypto's playground anymore.

When we're talking credit repair and debt purchasing, blockchain creates records that literally can't be tampered with. Ever. That's massive when you're dealing with financial data that absolutely has to stay clean and secure.

Take online poker, for example. Players can dive into these digital transactions knowing their credit data stays locked down tight thanks to blockchain's decentralized setup. In a world where data breaches happen every other Tuesday, that kind of peace of mind is priceless.

The Real Deal

Fintech isn't just tweaking debt purchasing and credit repair — it's torching the old rulebook and writing a new one. These four innovations are barely scratching the surface. As this tech keeps evolving, managing your finances will shift from being a massive headache to something that's actually streamlined and digital.

For everyone in the mix — consumers, banks, debt buyers — jumping on these technologies isn't really a choice anymore. It's survival of the fittest.

SITE DETAILS

Contact Us

99 Wall Street Suite 3343 New York, NY 10005

347-395-0485

contact@debtcatcher.com

Mon-Fri 9.00am - 6.00pm

Copyright 2024 © DebtCatcher.com All Rights Reserved