The Re-Emergence of the Debt Sales Market

In the mid-to-late 1980’s, U.S. consumer debt sales gained a lot of momentum as the three core constituents realized the practice was a win-win-win:

• Creditors (mostly banks) were able to recover charge-off losses by selling what they considered to be “uncollectible” debts

• Debt buyers were able to purchase portfolios of outstanding debts for pennies on the dollar and profit by collecting or reselling the debts

• Capital investors were able to profit by funding the purchase of debt portfolios

The rapidly growing debt buying market peaked in 2008 with annual revenues of about $10 billion before two, almost simultaneous factors, brought the market to an abrupt halt:

• High volumes of consumer complaints related to collections practices prompted governmental investigation and layers of new regulatory legislation

• The 2008 financial crash sent creditors, debt buyers and capital investors sprinting away from the debt market

However, the lessons learned from the history of the debt market have inspired new innovations that make the debt market compelling once again and are attracting buyers, sellers and investors back to this re-emerging financial opportunity.

Historical perspective

In the late eighties and early nineties, companies like Bank of America and Citibank lead the strategic trend of bundling old, delinquent and unpaid consumer accounts into asset-based debt portfolios and selling them to willing buyers at significantly discounted values.

Logical alternative for creditors

Even at discounted rates, selling uncollected debts was an accelerated strategy to recover some unpaid debt from written-off accounts. Plus, “moving on” was better than absorbing costs (sometimes millions of dollars) of internal debt management, audits, monthly reports and years of projected liquidation results. Once accounts were sold, liability transferred to the buyer and proceeds could be reinvested in a number of productive ways.

Attractive proposition for buyers

During the debt buying hay day, a 25-33% IRR on a portfolio investment was not uncommon and fueled a frenzy of rapid market growth. Debt buyers would “manage for profitability” and work accounts based on return rather than an assigned work matrix from clients. In some cases agency profit margins could more than double if buyers and their agencies worked only their own purchased paper.

The compliance conundrum—Dodd Frank and CFPB

Creditors never looked back once they transferred responsibility for sold debts. In addition, with very few specific legal regulations for debt buyers or self-policing industry checks and balances, some debt buyers stretched the rules and deployed some highly questionable collections tactics. Consumer complaints and lawsuits skyrocketed and in the wake of the 2008 recession, Congress passed the Dodd Frank Act, which included the Consumer Financial Protection Bureau (CFPB). Increasing lawsuits and regulatory limitations caused several leading debt sellers to pull way back on selling debt and many smaller buyers/agencies didn’t survive at all.

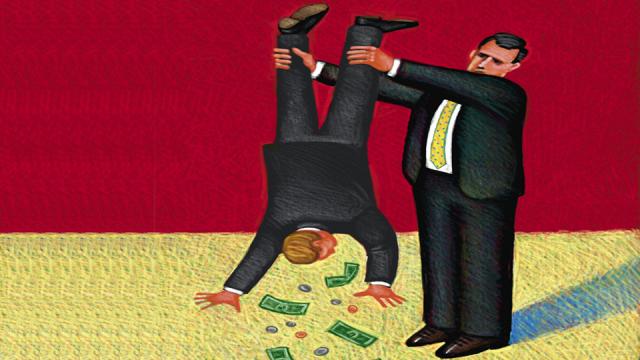

The flow of pressure

Today’s debt market landscape

Today’s landscape is much different from the height of the debt market. Volume and velocity of deal flow, and the number of sellers and buyers, have declined. Most market participants pulled back based on uncertainty within the debt industry.

Momentum toward data solutions

Participants in today’s debt market understand the long-term value of aligning to create market stability by conducting themselves in a responsible manner. Data technology will play an important role in this industry transformation and ongoing regulation.

Enhanced portfolio assessment: A key to market stability is transparency which provides insight into the market value of a portfolio. Important considerations for sellers now include compliance factors with respect to a portfolio being brought to market. Understanding how to analyze a prospective portfolio

through segmentation and stratification analysis is also critical to advancing a discussion relative to price. Of course the aspect of pricing is paramount when considering whether to sell accounts. Pre-sale portfolio analysis, known compliance issue extraction and financial modeling can be achieved with assistance from data providers.

Third-party portfolio assessment by qualified data providers can also provide this insight and be used to optimize buying decisions, maximize value and provide insights necessary to develop long range work treatment strategies.

Data-driven compliance: Portfolio segmentation analytics will drive more informed pricing expectations and serve as an impetus for creditors to return to debt sales as an alternative to agency placement. Why will data analytics be so valuable?

• Pre-sale analysis will help establish premium pricing.

• Quality portfolio preparation means cleaner sales and fewer future headaches.

• Deeper portfolio scrubs remove potentially problematic accounts.

• Modeling segmentation and recovery will provide liquidation expectations with a more realistic IRR.

Role of debt market brokers

Buying and selling a portfolio in today’s market requires multiple areas of understanding. Experienced brokers know the reputable buyers and sellers, have valuable deal pricing insights and understand the interests of both parties.The role of debt market brokers

According to Greg Paulo, VP at Flock Advisors, a debt industry financing firm, “the debt buying market is supported by a growing number of capital sources, the most prevalent being: individual investors, traditional bank financing, large PE firms and specialty finance companies. Each of these sources has different return expectations and securitization requirements. Banks and PE firms tend to have a more regimented funding product while most individual investors and specialty finance companies tend to be more flexible in their terms and risk tolerance levels. Brokers regularly match the needs of a buyer with funding sources in an effort to complete transactions and insure appropriate returns for both parties.”

Forward looking—2020

As of February 2016, total outstanding U.S. consumer debt stands at $3.6 trillion. If early 2016 activity is an accurate indicator of what’s coming, data technology will serve as a new foundation upon which the consumer debt sales market will make a slow but steady recovery. However, this time around, access to unprecedented amounts of data and advanced analytics will provide the basis for far more transparency and insight into debt portfolio make-up, the tools to meet compliance regulations efficiently and the proper checks and balances in place to maintain stability in the market. More specifically, potential market developments in the coming months and years are likely to include:

• Banks are expected to begin to re-engage with the consumer debt market.

• Streamlined due diligence will reveal important details about buyers, associates and funding sources in near real time.

• Capital partners will demand and have easy access to qualitative and quantitative portfolio evaluations from sources other than buyers.

• Commercially available data sources will provide extrapolated recovery models for more precise ROI projections.

• Buyers will have options to select the best tools to manage workflow decisions and profitable legal remedies.

• New players in the market, such as health care, subprime auto, prime auto and student loans could easily become significant participants in the market.

• Rules may restrict subsequent second tier sales.

• Access and inclusion of documentation will be a critical component of pricing.

• Balance substantiation will require backup statements to validate balance.

Conclusion: buyers and sellers… it’s safe to come back in the water

As outstanding consumer debt continues to grow and delinquency rates begin to climb, creditors are once again beginning to convert debt to dollars by reinstituting debt sales. As for buyers, there has clearly been vast improvement in the preparation and presentation of portfolios. More attention is being paid to what is included in the deal and what is not. Solutions are available to identify known compliance issues based on commercially available data sets. The transparency, quality and compliance-readiness of debt portfolios will continue to improve as big data technology from leading 3rd party data providers is integrated into the buying and selling processes.