Where to buy debt portfolios

If you want to purchase debt portfolios, you first need to find sellers! Usual sellers are banks and credit companies which most probably already are in business with debt buying companies that are able to put enough cash on the table to buy large portfolios every year. These portfolios are the residual of much larger […] Read More

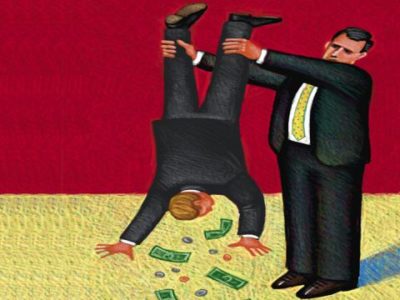

How to buy debt for pennies on the dollar

Before buying anything, ask yourself this very simple question: Am I going to use what I am buying or am I buying it to resell it to someone else? Talking about debt buying, this question could be asked this way: Am I going to try to collect this debt by myself, or ask a professional […] Read More

Debtcatcher is so disruptive, it could be Chinese…

Bad debts selling next to groceries on Taobao Banks, asset managers starting to use non-traditional ways to dispose of assets BEIJING (BLOOMBERG) – Among the groceries, diapers and pet food for sale on Taobao, China’s biggest e-commerce platform, is a listing that may take up a little more space in the online shopping basket. For 4.15 […] Read More

Could it be that the Debtcatcher community was at the leading edge even before ECB came up…?

Exclusive: ECB prepares ‘bad bank’ plan for wave of coronavirus toxic debt By Matt Scuffham, John O’Donnell LONDON/FRANKFURT (Reuters) – European Central Bank officials are drawing up a scheme to cope with potentially hundreds of billions of euros of unpaid loans in the wake of the coronavirus outbreak, two people familiar with the matter told Reuters. The […] Read More

FCCCO Award

We are proud to announce that The FCCCO – France Canada Chamber of Commerce Ontario, has shortlisted debtcatcher.com as finalist at the French Tech Toronto Summit – Les Innovateurs 2020!Looking for disruption, innovation in smart Credit Management ? We are moving the lines.Stop waisting time in collecting receivables. Just sell them. #FCCCO#frenchtech#debtcatcher#creditmanagement Read More

COVID has infected your treasury. Smart leaders have added innovative remedy.

COVID has opened the Pandora box of an unprecedented situation regarding cash management. As great as your usual debt collection strategy and actions on cash, DSO, dispute management might be, smart leaders are now thinking out of the box in creative cash management strategies.One of the options that provides powerful and potentially short term outcomes […] Read More

Debt Buyers — Shrinking Opportunities Amid Regulatory Reform

By Michael R. FlockAs the pool of available credit portfolios has shrunk, many debt buyers have failed to diversify into other types of credit. Michael Flock notes that specialty lenders need to develop new solutions for a wider variety of portfolio asset classes amid increasing regulatory challenges that are changing the playing field.The shrinking number […] Read More

Statute of Limitations on Debt in the US

State Oral Written Promissory Open Alabama 6 6 6 3 Alaska 3 3 3 3 Arizona 3 6 6 3 Arkansas 3 5 3 3 California 2 4 4 4 Colorado 6 6 6 6 Connecticut 3 6 6 3 Delaware 3 3 3 4 Florida 4 5 5 4 Georgia 4 6 6 6 […] Read More

Report On Risks In Online Debt Sales Market Is Released

WASHINGTON—As part of its multi-pronged effort to inform public understanding of the debt collection industry, the CFPB has released a Report On Risks in the Online Debt Sales Market, which highlights potential risks to consumers’ personal information posed by debt sales online. The Bureau has also released its first-ever national survey of consumer experiences with […] Read More

The Re-Emergence of the Debt Sales Market

In the mid-to-late 1980’s, U.S. consumer debt sales gained a lot of momentum as the three core constituents realized the practice was a win-win-win:• Creditors (mostly banks) were able to recover charge-off losses by selling what they considered to be “uncollectible” debts• Debt buyers were able to purchase portfolios of outstanding debts for pennies on […] Read More